Monthly Market Insights | March 2023

US Markets

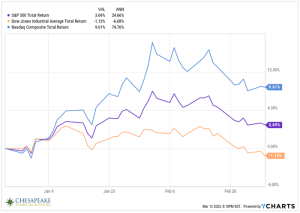

Stock prices stumbled in February due to growing worries that the Fed would maintain its tight monetary posture in the face of continuing inflation.

For the month, the Dow Jones Industrial Average lost 4.19%, whereas the Standard and Poor’s 500 Index fell 2.61%. The Nasdaq Composite which was up nearly 11% in January, dipped 1.11% in February.

Strong Start Toppled

The month began the way January ended, with stocks climbing higher on solid earnings reports and encouraging inflation data. The markets enthusiastically greeted the Fed’s 0.25% hike in interest rates, relieved that the increase was in line with expectations. Spirits were further lifted by constructive comments made by Fed Chair Jerome Powell following the rate hike announcement.

The optimism did not last long, however. Stocks struggled as the direction of future monetary policy weighed on investors throughout the month.

Uncertainty with Interest Rates

Despite an initial upbeat assessment by Powell at the post-meeting press conference, a strong employment report fanned fears that the Fed would be unable to pause rate hikes anytime soon.

By mid-month, a higher-than-expected increase in consumer prices, strong retail sales numbers, and a rise in producer prices made it clear that the Fed would need to remain vigilant.

The Slide Continued

The slide in stock prices continued into the end of the month, dragged down by further rate hike concerns and disappointing guidance from two major retailers that called into question consumer health. Stocks felt even more pressure after January’s Personal Consumption Expenditures (PCE) price index, the Fed’s preferred benchmark for gauging inflation, reflected hotter-than-expected price increase and vigorous consumer spending.

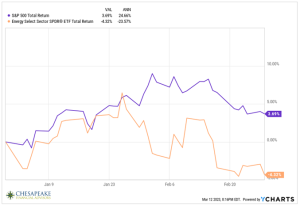

Sector Scorecard

One silver lining regarding the difficult month was that the technology sector, one of the worst-performing groups in 2022, notched a slight gain of 0.41%.

The remaining sectors retreated, mainly led by Energy (-6.95%) due to a milder winter than expected, Utilities (-5.92%) and Real Estate (-5.86%). These cyclical sectors will continue to be volatile as we make our way through what we anticipate to be a choppy 2023.

What Investors May Be Talking About in March

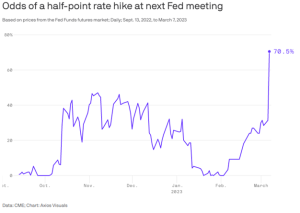

The Federal Open Market Committee (FOMC) is scheduled to meet on March 21-22, and the Fed at its previous meeting indicated that it intends to raise short-term interest rates by another 0.25%.

However, the Fed will now need to digest fresh information on the labor market and inflation that may impact its upcoming rate decision. Since Powell’s testimony on March 7th, futures show more than a 50% chance of a 0.50% hike in March. Bringing expectations for rates to rise to a 5.25% – 5.50% range by June.

Investors will be keenly dissecting the FOMC meeting announcement. In the Fed’s previous meeting, Powell acknowledged that a disinflationary trend has emerged, but he also cautioned that the Fed will evaluate the labor market and new inflation data for further guidance.

As such, it may be more Powell’s comments, rather than the expected rate hike, that move the markets and set the tone for the weeks to follow.

World Markets

The prospect of higher rate hikes in Europe and questions about the pace of China’s reopening, sent overseas stocks lower in February, with the MSCI-EAFE Index slipping -2.07%.

European markets were higher, with Germany picked up 1.57% and the U.K. tacked on 1.35%. Asia markets fell sharply as China’s Hang Seng dropped 9.41%.

Indicators

Gross Domestic Product (GDP)

Economic growth in the fourth quarter was revised lower to 2.7% from its initial estimate of 2.9%. The downward revision was primarily attributable to lower consumer spending than originally estimated.

Employment

New hires in January surged by 517,000, sending the unemployment rate to a 53-year low of 3.4%. Despite the robust job gains, wage growth remained below inflation, rising 4.4% from the previous January. The labor force participation rate rose slightly to 62.4%.

Retail Sales

Consumer spending rebounded in January, climbing 3.0%. Retail sales exceeded estimates, coming off two consecutive months of declines.

Industrial Production

Industrial production was unchanged in January, dragged down by a drop-off in utilities output owing to an unseasonably warm January. Manufacturing and mining increased production after two months of decline, rising 1.0% and 2.0%, respectively.

Housing

Housing starts dropped by 4.5%, with single-family home starts declining 4.3%. Year-over-year housing starts tumbled 21.4%.

Sales of existing homes lost 0.7% from a month ago, falling to the lowest level in more than 12 years. Year-over-year sales declined by 36.9%.

New home sales rose 7.2%, the highest rate in nearly a year. The unexpected increase was the result of a surge in sales in the South, with all other regions experiencing declining sales.

Consumer Price Index (CPI)

Consumer prices firmed in January, rising 0.5%. The gain was an increase from the prior month and higher than consensus estimates. However, the year-over-year increase of 6.4% came in below the prior month’s 12-month rise of 6.5%, the seventh consecutive month of year-over-year declines. Core inflation (which excludes energy and food) was 0.4%, whereas the year-over-year increase was 6.4%, a tick lower than December’s 6.5% year-over-year read.

Even though we are seeing year-over-year inflation continue to fall, the biggest concern for investors is the continuously high month-over-month Core PCE (Personal Consumption Expenditures) & Core CPI (Consumer Price Index) as seen below. This is a sign that inflation is not slowing at a rate the Fed would like it to be, and they are left with having to make decisions to continue to raise in the face of a possible recession or let prior rate hikes play out in this economy.

Durable Goods Orders

Durable goods orders declined 4.5% largely owing to a comparison anomaly in which a historically large order for aircraft was booked in December, leading to a month-over-month drop. Excluding transportation, orders were up 0.7%.

The Fed

The minutes from the last meeting of the FOMC indicated that nearly all members favored the decision to raise rates by a quarter percentage point.

However, some Fed governors indicated they were inclined to vote for, or would have also voted for, a 0.50% hike to more quickly achieve the Fed’s target range for short-term interest rates.

The minutes also suggested that the Committee may hike rates by a quarter percentage point at its next meeting, which is scheduled for March 21-22.

ONE ADVISOR | TWICE THE ADVICETM

Find out if you are on track for retirement, give us a call at (410) 823-5442 or email invest@peakeadvisors.com.

For disclaimer, please follow our link below:

https://www.peakeadvisors.com/site/wp-content/uploads/2019/05/Compliance-Social-Media-Disclaimer.pdf