Monthly Market Insights | August 2022

View Matt’s Monthly Market Insights on YouTube Here

US Markets

Stocks posted big gains in July, erasing some first-half losses. Investors attitude was encouraged by potential lowered inflation and recession worries and a better-than-expected start to the second quarter earnings season.

The Nasdaq Composite lead the indices gaining 12.35% while the Standard & Poors 500 Index 9.11% and The Dow Jones Industrial Average gained 6.73%.

Hopeful Signs:

Stocks have been under pressure all year due to rising inflation and slowing economic growth. There were not many signs in July that suggested inflation would begin to decrease or that the economy was set for a rebound. Nevertheless, investors saw falling energy prices and persistent strength in the labor market as hopeful signs that an economic downturn may not be as severe as some expect.

Earnings Help Rally:

Investor sentiment improved further as earnings season got underway in the back half of the month. This increased optimism was not a result of exceptional earnings results but rather more attributable to the fact that earnings were not nearly as weak as many had feared. Companies painted a picture of a reasonably healthy consumer and businesses continue to effectively navigate inflation and supply chain challenges.

Big Week of Data:

The month of July brought us perhaps the most critical week of the summer for the market, with investors awaiting information on corporate earnings, a Fed meeting decision on interest rates and the release of an initial estimate of the second quarter GDP.

Investors Impressed:

Earnings came out of the gate a bit shaky as a big box retailer missed earnings and guided future earnings estimates lower. However, subsequent earnings reports from big tech companies impressed investors. Markets were further relieved by the Fed’s decision to hike rates by 0.75% and Fed Chair Jerome Powell’s comment that the pace of future rate hikes may slow.

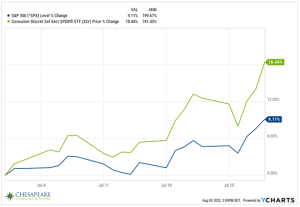

Sector Scorecard:

All industry sectors posted gains in July with the Consumer Discretionary sector leading the way up 18.4% thanks in part to short covering mainly in the auto industry.

What is Everyone Talking About in August

Historically, August has been a positive month for stocks, with an average return of 0.7% for the month.

During the month, the government will release a string of economic reports to give the Fed fresh insight into the economy for its late September meeting. After, September, the Fed only has two scheduled meetings for the rest of 2022, one in early November and one in mid-December.

World Markets

World Markets rallied following the lead of the US markets. The MSCI-EAFE Index gained 3.74% in July.

Major European markets overcame growing recession fears and deepening energy woes. While major Asian markets were mostly higher, except for Hong Kong which lost 7.79%.

As you can see in the below chart, developed markets across the world continue to lag behind the US market.

Indicators

Gross Domestic Product (GDP):

The economy shrank at an annualized rate of 0.9% in the second quarter as consumer spending slowed and businesses reduced inventories. GDP posted its second straight quarter of negative growth, meeting the technical definition of a recession. Unlike most recessions though, the past two quarters have been marked by strong employer hiring.

Employment:

Employers added 528,000 new jobs in July, which beat the 258,000 estimates for the month. Leisure and hospitality led job creation this month while June jobs report was led by Education and health services. The unemployment rate decreased to 3.5%, while wage growth increased 5.2% year-over-year in July as we continue to see inflation out pacing wage growth.

Retail Sales:

Retail sales increased 1.0% in June, beating consensus estimates. Gasoline stations, online sales and bars and restaurants were some of the biggest contributors.

Industrial Production:

Industrial production declined 0.2% in June mainly due to manufacturing and utilities production decreasing.

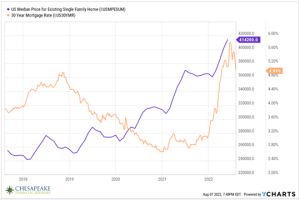

Housing:

Housing starts slipped 2.0% as rising prices and increased mortgage rates weighed on buyer demand. It was the second consecutive month of declines.

Existing home sales fell 5.4%, while the median sales price climbed 13.4% to another record high of $416,000.

New home sales declined 8.1% in June, falling to levels not seen since April 2020. Year-over-year sales were down 17.4%.

In the chart below, you can see the abnormal sharp spike in 30-year mortgage rates over the past year while home prices have risen. This is putting a great deal of stress on the market and pricing out buyers.

Consumer Price Index (CPI):

Consumer prices climbed 1.3% in June. The 12-month increase was 9.1%, a 40+ year high. Core inflation (excluding food and energy prices) remained elevated as well, rising 0.7%.

Durable Goods Orders:

Orders for products designed to last three years or more rose 1.9%. When excluding defense spending, durable goods orders were only up 0.4%.

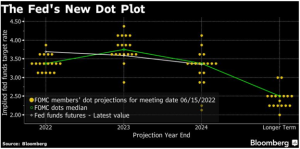

The Fed

The Fed officials agreed to a 0.75% rate hike in the federal funds rate, acknowledging that the economy has slowed since the last meeting in June.

In a post-meeting press conference Fed Chair Jerome Powell said that future rate hikes would be made on a meeting-by-meeting basis and that it may become appropriate to slow the pace of future interest rate hikes.

This statement was very important to how the markets reacted following the press conference on July 27th. With the potential for slower rate hikes, the market has increased 3.1%. But, following the latest jobs report, this could be exactly what the Fed officials needed to confirm that the economy is able to with stand faster rate hikes to combat inflation at 40+ year highs. Could we see a mid-meeting rate increase? Or will the Fed committee wait until their next meeting in September? Time will tell, as investors try to figure out the markets next move in the month ahead.

Insights delivered right to your inbox | Sign up

WE’RE HERE TO HELP

Give us a call today (410) 823-5442 or email invest@peakeadvisors.com.

For disclaimer, please follow our link below:

https://www.peakeadvisors.com/site/wp-content/uploads/2019/05/Compliance-Social-Media-Disclaimer.pdf