Posts Tagged ‘Stock Market’

2020 First Quarter (Q1) Market Commentary

Most economic slowdowns occur over time with a slow deterioration of Employment, Consumer Confidence, and Gross Domestic Product (GDP). Companies generally tighten their belts and the Fed and Government make monetary and fiscal policy changes to help soften the blow and eventually we come back slowly. It’s called the business cycle. We have been going…

Read MoreClient Alert: Coronavirus and Market Conditions – A Note from Tom & Tim

Over the weekend, oil prices dropped by about 20-30% as Saudi Arabia slashed its export oil price likely starting a price war with Russia. This spooked the markets which were already on edge with the spread of the Coronavirus. As a result, we saw the stock market drop 7% at the open this morning and the…

Read MoreCoronavirus Concerns? Consider Past Health Crises

During the last week of February 2020, the S&P 500 lost 11.49% — the worst week for stocks since the 2008 financial crisis — only to jump by 4.6% on the first Monday in March.1 By all accounts, the drop was largely driven by ever-increasing fears about the potential effects of the coronavirus (COVID-19) and its…

Read More2019 Q4 Market Commentary

One year ago, the market was convinced that our economy was headed for a recession and we began 2019 on the heels of one of the worst quarterly market returns in more than a decade. This could not have been further from the truth. Once the market figured out that a recession was not happening,…

Read More2019 Q3 Market Commentary

During the quarter we saw two major market indicators, both with drastically different signals for market watchers. The first and most publicized was the inversion of the yield curve. There are many different measures for this; but in a nutshell, the yield on the 2-year Treasury note was higher than the yield on the 10-year…

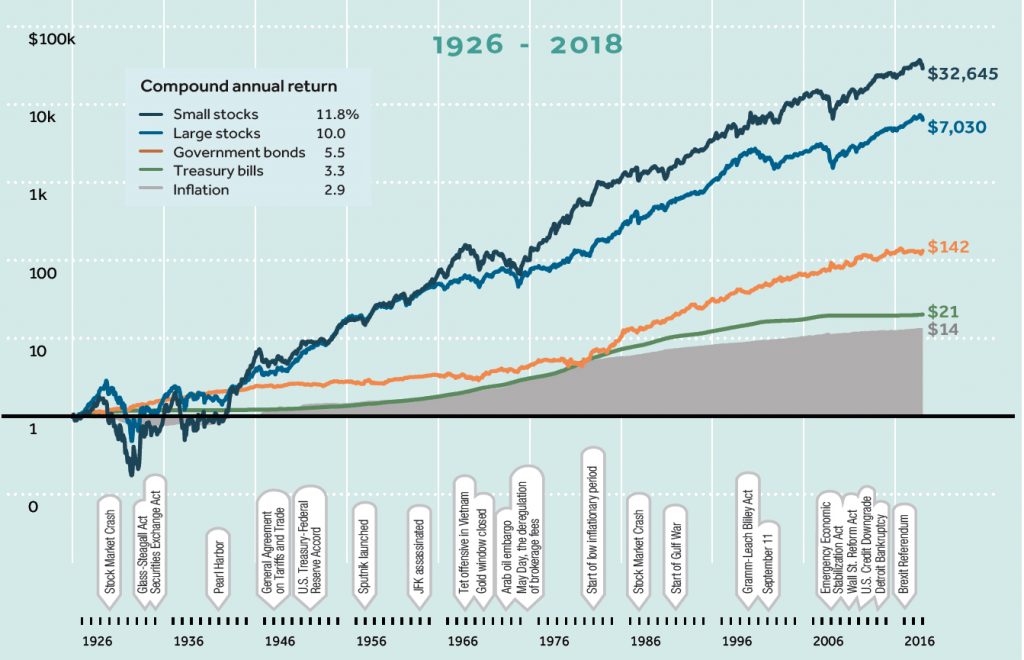

Read MoreUnderstanding Risk

Few terms in personal finance are as important, or used as frequently, as “risk.” Nevertheless, few terms are as imprecisely defined. Generally, when financial advisors or the media talk about investment risk, their focus is on the historical price volatility of the asset or investment under discussion. Advisors label as aggressive or risky an investment…

Read More2018 Q3 Market Commentary

After watching the market yo-yo higher and lower in the first 6 months of 2018, it finally gained some traction on the heels of a stronger economy and fantastic earnings announcements. It seemed like every day during earnings season we got news of another company beating the analyst estimate and raising their outlook. Additionally, strong…

Read More2018 Q2Market Commentary

Looking back on our commentary written in early January we see that the S&P 500 closed at 2,673.61. It now stands at 2,718.37 as of the close of the 2nd quarter – up a whopping 1.7% for the year. It’s hard to put a positive spin on that kind of return but in all reality,…

Read More2017 Q4 Market Commentary

It was quite a year driven by earnings growth and the hope and realization of deregulation and tax-reform. We began the year at 2,238.83 on the S&P 500 following earnings of $106.26 for 2016. In 2017 those earnings rose to $124.94 – an increase of 17.6% which is stellar by any measure. As we approach…

Read More3rd Quarter 2017 Market Commentary

The Dow Jones Industrial Average posted a gain of 4.9% during this past quarter. It was the eighth consecutive quarter with a gain. This is the first time this has happened in 20 years. During this eight quarter period, the Dow posted a gain of 37.6%. That compares to a gain of 65.9% for the…

Read More