Client Alert: Coronavirus and Market Conditions – A Note from Tom & Tim

Over the weekend, oil prices dropped by about 20-30% as Saudi Arabia slashed its export oil price likely starting a price war with Russia. This spooked the markets which were already on edge with the spread of the Coronavirus. As a result, we saw the stock market drop 7% at the open this morning and the “Circuit Breakers” kicked in to shut down the market for 15 minutes. Upon the re-open shortly before 10:00 AM, the markets stabilized but remained sharply lower (down about 5.5-6.0%) as we traded over the next hour. As we pushed into the afternoon, the market was down less than 5.0% at one point and there were no more disruptions in trading. Despite the carnage, the trading appears to be orderly and functioning which is a good thing. Essentially, the market had to digest the weekend’s news into the opening trade which is hard to do.

Clearly, the market remains on edge and while oil prices were the reason today, the Coronavirus remains front and center on the radar of traders. Fortunately, the economy was on solid footing ahead of this. In fact, the February Jobs number was a blowout with over 270,000 jobs being added in February and the unemployment rate dropping to 3.5%. All good news, albeit in the past. Unfortunately, the market likes to look forward and what lies ahead is certainly unknown. The big unknowns are how long will this Coronavirus last and how deep will it go? As we have said many times before, the market does not like uncertainty and when presented with an issue like this, it often shoots first and asks questions later.

This too shall pass

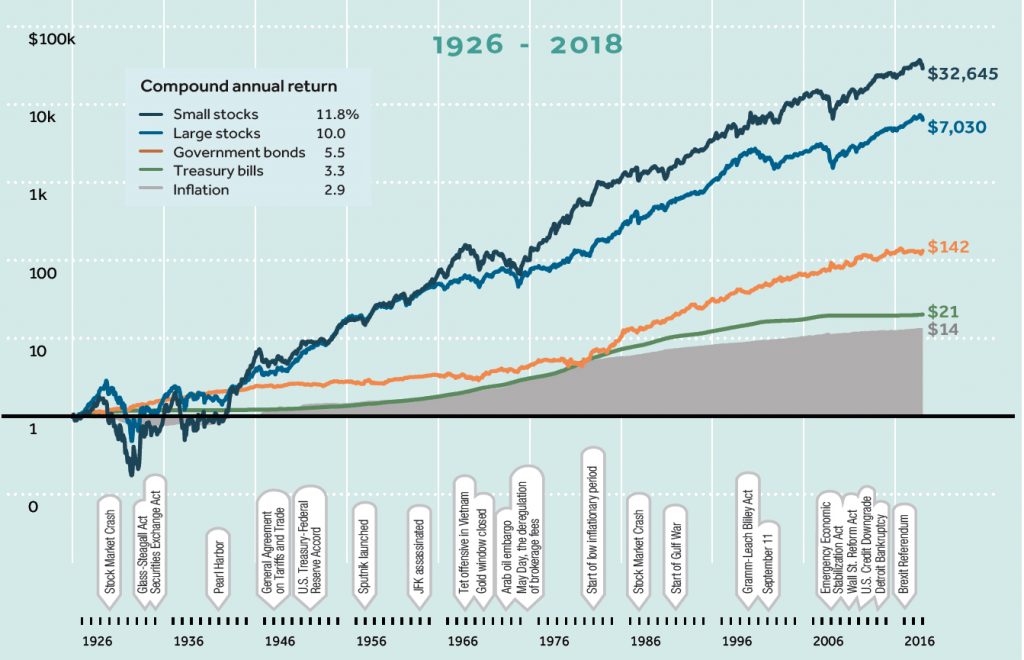

Our experience of having managed through the tech wreck in the 90’s, 9/11, recessions, wars, the great recession and most recently in 2018 when the market last fell 20%, gives us the confidence that this too shall pass. We believe that in time, this will be another blip on the long-term growth of your portfolio and net worth. We remain vigilant to our long-term plan for your portfolio and in every case, the markets always stabilized and headed higher.

You can check out our latest blog to see some statistics on the opportunities available after the previous Epidemic scares:

Coronavirus Concerns? Consider Past Health Crises

https://www.peakeadvisors.com/site/blog/2020/03/05/coronavirus-concerns-consider-past-health-crises/

Buying Opportunities

As you may be aware, we are always looking for ways to take advantage of the short-term panic and turn it into long-term gain. As a result of the stock market drop, the money has been flowing to the bond market, which has seen yields plummet to record lows. While we remain in this environment, there may be things that you can take advantage of to better your financial situation. With the rates at all-time lows, it is a great opportunity to take a fresh look at your current mortgage or other debt. This could be a great opportunity to perhaps save on monthly payments and improve cash flows or perhaps lop some years off of your mortgage. We are constantly watching the markets and more importantly, the underlying fundamentals of the market and the economy, but it does not distract us from long-term opportunities.

Hang in there, we’re going to be just fine.

Sincerely,

Tom & Tim

p.s. The chart above shows all of the substantial swings in the market since 1926 and how it has come back even stronger.

For disclaimer, please follow our link below:

https://www.peakeadvisors.com/site/wp-content/uploads/2019/05/Compliance-Social-Media-Disclaimer.pdf